April 20, 2025: Saturn Conjunct Venus Will Set Interim TOP for the Market

The US stock market indices went down last week with choppy and volatile sessions. The S&P 500 and Nasdaq Composite experienced declines of 1.50% and 2.62%, respectively, while the Dow Jones Industrial Average fell by 2.66%. In contrast, the Nifty index in India rose by 4.48%, indicating regional resilience.

Regarding tariffs and economic data, recent announcements of increased tariffs have sparked concerns about inflation and slower economic growth. Businesses have been importing heavily to get ahead of potential tariff hikes, which may weigh on GDP growth. Meanwhile, consumer spending showed modest growth, but sentiment surveys revealed a dip due to trade policy uncertainties.

In his speech last week, Fed Chair Jerome Powell highlighted that inflation has eased significantly but remains slightly above the target of 2%. He emphasized the labor market's stability and the progress in reducing inflation, while acknowledging uncertainty about the economic impact of new trade policies.

Astrological Outlook for the Week Starting April 20, 2025

- Mercury Regular Speed: Mercury will come back to regular speed completely, putting things back to normal.

- Debilitated Mars: Mars transit in Pushya nakshatra does not look great for stock market indices, but its impact will be limited.

- Venus Direct: Venus and Saturn conjunctions could set a market TOP by Thursday or Friday this week.

- Exalted Sun: Sun gets exalted, which is a bullish indicator for the stock market.

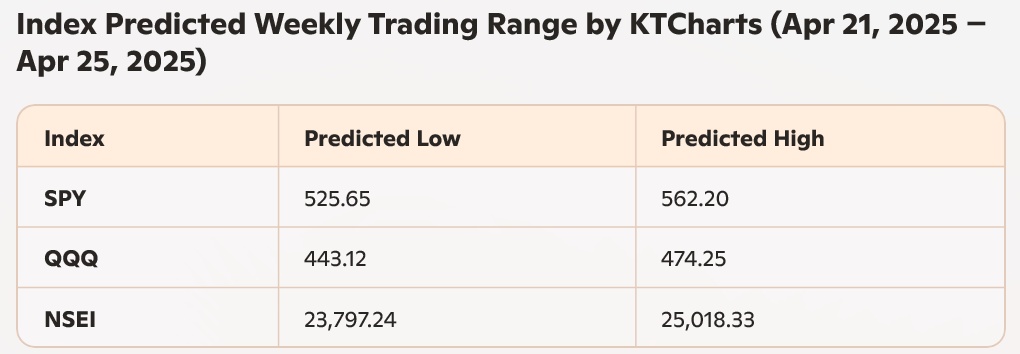

As mentioned, I believe that the market bottom for 2025 was already set on April 7, 2025. We are unlikely to return to those levels until we see substantial rallying for the rest of 2025. The Saturn and Venus conjunction indicates the market will set an interim TOP later this week and may give back some gains in the week of April 27, 2025. If we gain over 5%–7% this week, then it would be a good idea to cash out your profits.

Trading Guidance

Given the expected volatility this week:

- Avoid short-term options: Daily or weekly trades might be too risky due to large market swings.

- Accumulate stocks: Use market dips to gradually build positions in your preferred stocks.

- Explore long-term options: For high-risk traders, consider buying 2026 yearly options during market downturns.

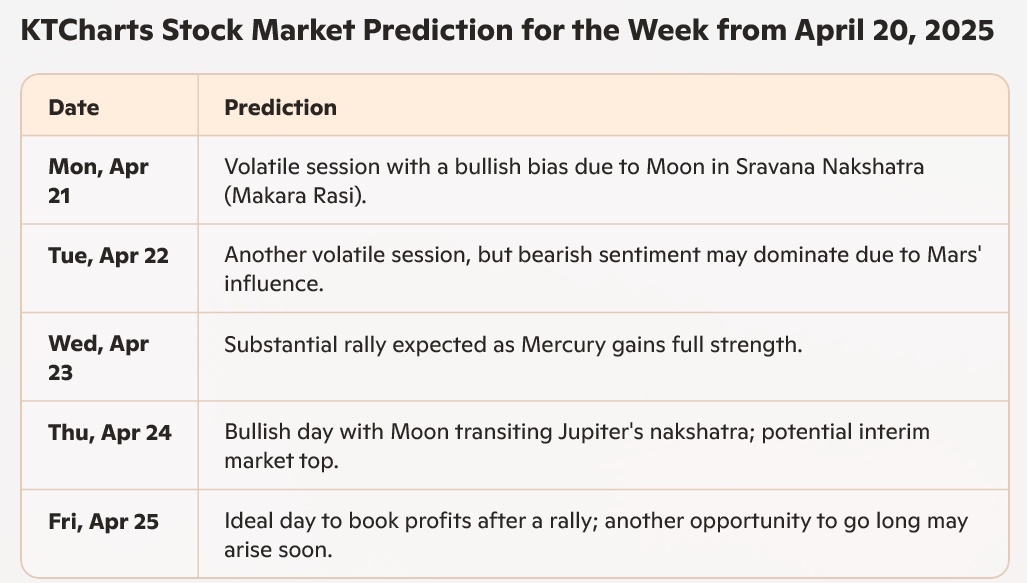

Weekly Trading Forecast

Content copyright 2023-2025. Arcturus IT & Data Consulting LLC. All rights reserved