May 11, 2025: Market to peak ahead of Jupiter transit for FLASH crash from later this week.

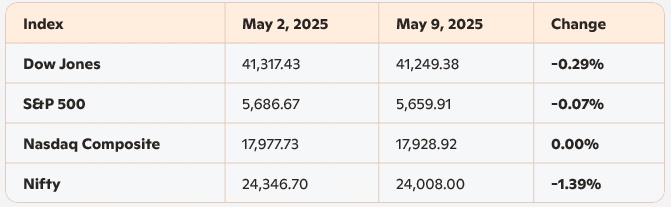

May 11, 2025 - Over the past week, stock indices showed mixed performance:

- Dow Jones fell 0.29%, closing at 41,249.38.

- S&P 500 dipped 0.07%, settling at 5,659.91.

- Nasdaq Composite remained flat, ending at 17,928.92.

- Nifty saw the biggest decline, dropping 1.39% to 24,008.00.

The stock market faced volatility due to various economic factors:

- GDP contraction: The U.S. economy shrank 0.3% in Q1 2025, marking its first decline in three years.

- Tariff concerns: Investors remain cautious as U.S.-China trade talks continue, with potential tariff reductions.

- Earnings season: Major companies, including Amazon, Apple, Meta, and Microsoft, reported earnings, influencing market sentiment.

- Federal Reserve decision: The Fed held interest rates steady, citing concerns over inflation and unemployment.

Overall, market uncertainty remains, but investors are watching trade negotiations and upcoming economic reports for direction.

Astrological Outlook for the Week Starting May 11, 2025

Jupiter transit is getting very close and happens on Wednesday morning before the market opens. I expect the stock market to set a peak on Tuesday ahead of Jupiter transit and start selling off from Wednesday. It is a good idea to stay in cash for the next few days, at least until mid-next week.

I expect S&P 500 to trade above 5800, to be more precise around 5857, and that could trigger the market’s selloff. This crash cycle will take about two weeks starting from Wednesday, May 14, 2024.

Interestingly, Rahu and Ketu are also transiting by next weekend, which will amplify bearish energies. Still, I believe the low for this year 2025 is already set, which was on April 07, 2025. We are unlikely to go below that level. But I predict that S&P 500 will crash by 8 to 10% to trade below the 5250 zone by later this month.

Trading Guidance

- Avoid short-term options: Daily or weekly trades might be too risky due to large market swings.

- Accumulate stocks: Use market dips to gradually build positions in your preferred stocks.

- Explore long-term options: For high-risk traders, consider buying 2026 yearly options during market downturns.

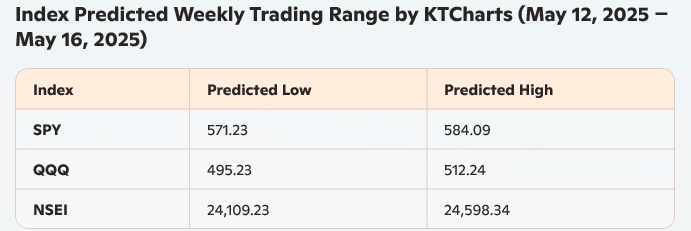

Weekly Trading Forecast

Content copyright 2023-2025. Arcturus IT & Data Consulting LLC. All rights reserved